En

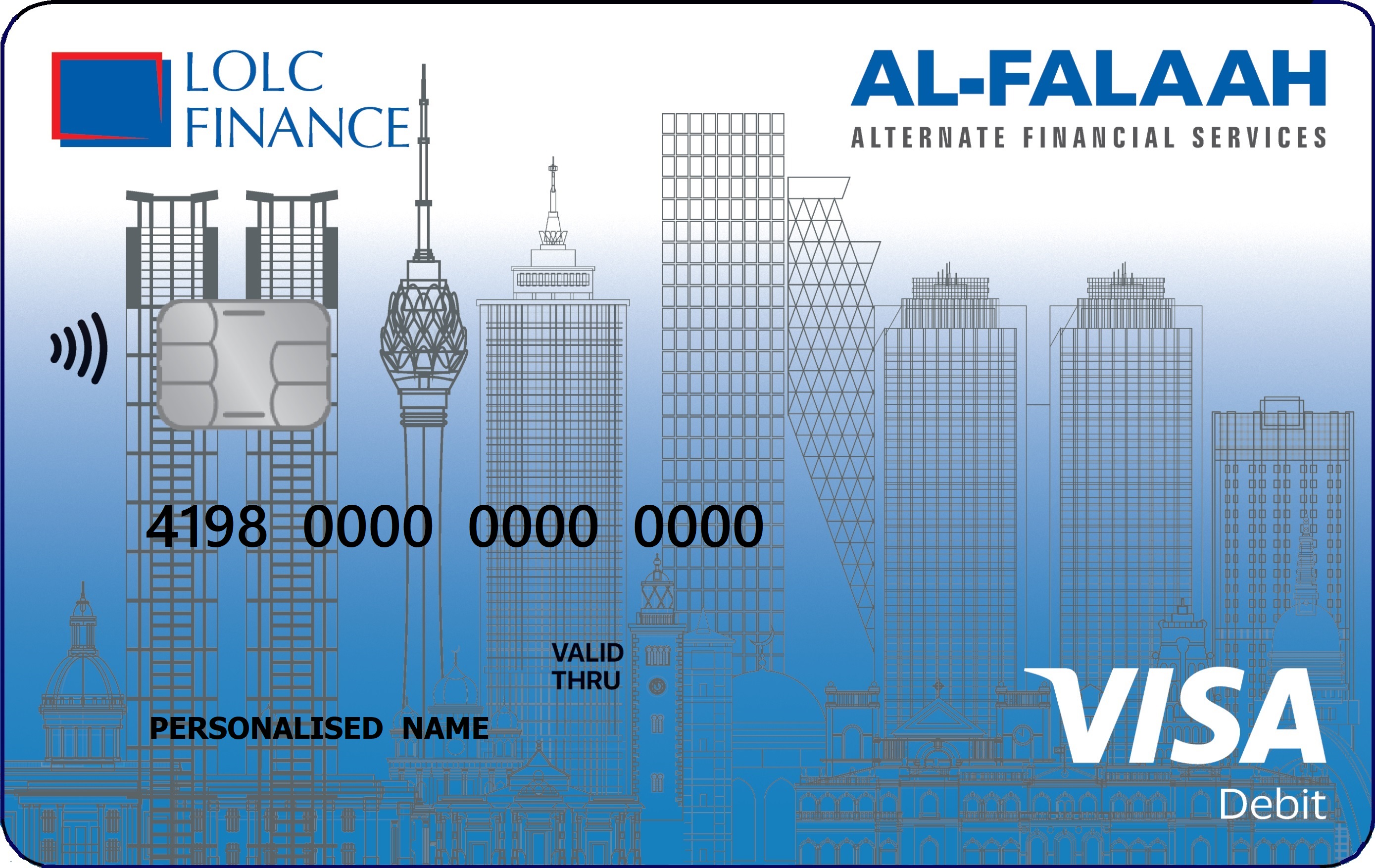

The latest Al-Falaah Debit Card introduced by LOLC Finance

In a groundbreaking initiative that reaffirms its position as a leading Islamic financial service provider in Sri Lanka, LOLC Al-Falaah the Alternate Financial Services unit of LOLC Finance proudly announces the re-launch of its new upgraded International Debit Card. This latest offering is designed to deliver enhanced convenience, security, and financial empowerment while staying true to the principles of Islamic banking.

The upgraded LOLC Al-Falaah International Debit Card features EMV chip technology, ensuring every transaction is encrypted and protected, giving customers peace of mind as they navigate physical and digital financial landscapes, whilst processing local and international transactions. The Card is a dual-interface Visa Debit card, allowing customers to perform contact and contactless transactions across various local and international payment platforms. With dual-network functionality, customers can now access ATM services and perform debit card transactions locally and globally. The card is accepted at all VISA merchant outlets across Sri Lanka and overseas, offering users a convenient and borderless payment solution.

LOLC Al-Falaah’s Debit Card is cost-effective to use and is the only debit card in the market that includes zero joining fees, annual fees, ATM withdrawal charges, hidden transaction fees for usage, giving account holders full access to their actual account balance. Customers can also benefit from real-time SMS alerts for all transactions along with exclusive discounts and special offers lined up with over 100 merchants, positioning the card as a practical and rewarding financial tool, going forward.

The introduction of the latest Debit Card stands as a core component of LOLC Al-Falaah’s broader strategy to enhance the banking experience of existing investors as well as potential new customers across Sri Lanka. The card promotes ethical and responsible spending while expanding financial inclusion, particularly in underserved and rural communities. It offers access to digital payments through its expansive branch network, ensuring modern, secure banking for all customers regardless of geography or income in a manner aligned with their values.

Sharing his thoughts on this milestone launch, Mr. Shiraz Refai, Head of Alternate Financial Services at LOLC Al-Falaah, stated, “Managing one’s finances effectively while staying true to one’s beliefs and moral values is essential. At LOLC Al-Falaah, we have long believed in enabling our customers to pursue financial independence without compromising their faith. Through this debit card upgrade, we take yet another step towards building an inclusive, ethical, and accessible financial ecosystem, one where every Sri Lankan, whether a seasoned investor, small-business owner, or daily wage earner, has the tools and guidance needed to thrive. Our commitment goes far beyond just providing services; we build relationships. We stand by our customers in times of need, guiding them toward regulated financial accessibility and away from exploitative, unregulated lending practices. We invest in communities through educational initiatives and financial literacy programs, empowering them with the greatest wealth of all: knowledge. The introduction of this upgraded debit card represents not just a payment tool, but a meaningful leap toward financial dignity, inclusivity, and sustainable prosperity for all.”

Adding to this Mr. Shafin Iqbal, Manager-Institutional Marketing, remarked “We are excited to announce the launch of our re-branded and upgraded high-tech debit card, a breakthrough in delivering secure, convenient, and inclusive financial services. This launch represents a significant milestone in our brand’s ongoing transformation toward becoming a technology-driven, customer-centric financial institution. Beyond its technological advancements, this card exemplifies LOLC Al-Falaah’s core brand values of trust, innovation, and social responsibility. By expanding access to digital payments, we are empowering underserved communities to participate more actively in the formal economy. This contributes not only to individual financial empowerment but also to broader societal progress through improved financial inclusion and economic development. With our commitment in transforming the way financial services support and uplift society, the new debit card is a vital step in realizing this vision, offering customers a safer, smarter way to manage their finances while fostering greater economic participation across the communities we serve.

The LOLC Al-Falaah Debit Card is now available at any of the 200+ LOLC branch locations island wide. This launch marks another chapter in LOLC Al-Falaah’s steadfast mission to provide complete and innovative alternate financial solutions that serve people from all walks of life creating meaningful impact, trust, and progress.

Mr. Shiraz Refai, Head of Alternate Financial Services at LOLC Al-Falaah

Mr. Shafin Iqbal, Manager-Institutional Marketing